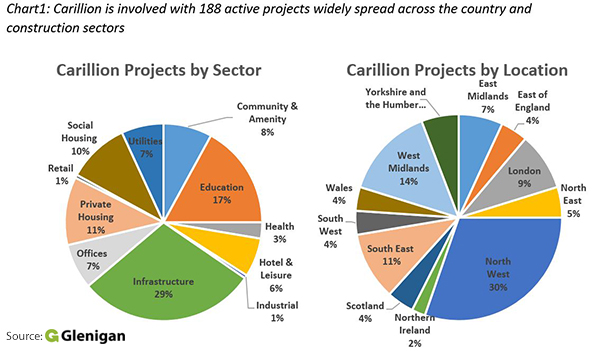

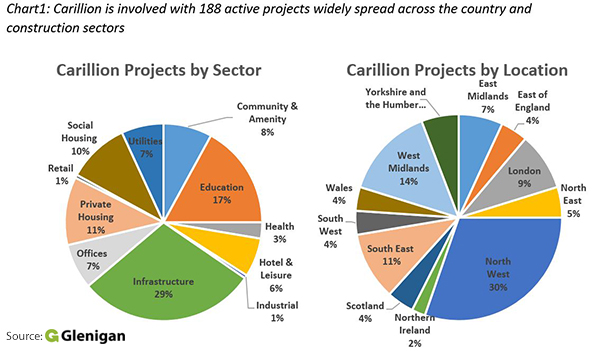

Carillion’s collapse

is generating risks and opportunities that will ripple across the construction

industry over the coming weeks and months, according to Glenigan.

The failure of a

firm of Carillion’s size has significant implications, not only for its clients

and employees, but also its supply chain and competitors.

Glenigan is keeping

under review all 188 active construction projects with which Carillion is

involved, including frameworks and joint ventures. We will provide subscribers

with updated contact details and status reports on individual projects as they

become available, including the re-tendering of contracts.

Infrastructure and

public sector projects account for the majority of Carillion’s project

workload, although the firm is involved in a wide range of projects spread

across the UK.

Encouragingly the

Government has announced that it will provide “the necessary support to ensure

that continuity of public sector services provided by the firm”. The Official

Receiver, PwC, has also stated that its priority is to ensure the continuity of

public services while securing the best outcome for creditors. PwC are asking

all employees, agents and subcontractors to continue to work as normal, unless

told otherwise, and have announced that they will be paid for the work they do

during the liquidations.

Carillion’s collapse

holds clear risks, not only for suppliers’ cash flow and balance sheets, but

potentially for the wider industry’s supply chain. Whilst the official receiver

has reassured subcontractors that they will be paid for future work on Carillion

projects, subbies and suppliers will join the list of creditors for any

payments on outstanding work. Main contractors will wish to assess the exposure

of their own supply chain and to work with them to minimise any risks.

Carillion were

partners on a number of joint ventures, including the Aberdeen Western

Peripheral Route and HS2. The other contractors on these projects will be

expected to take on the firm’s obligations. Whilst this will potentially boost

their earnings, it will also be an additional and unscheduled call on their

resources. Among other things the increased workload may dampen the firms’

appetite to bid for new projects in the near term.

Furthermore the loss

of such a major player threatens to reduce overall industry capacity,

particularly for the delivery of major projects. This has implications for

clients, especially for the Government as it looks to increase infrastructure

investment as part of its Brexit strategy. Clients may choose to re-organise

major projects in the future in order to increase the opportunity of a wider

range of contractors, including medium sized firms to undertake such work.