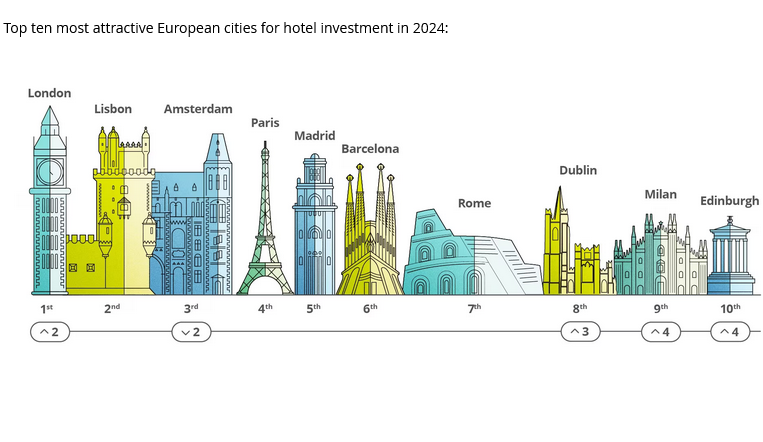

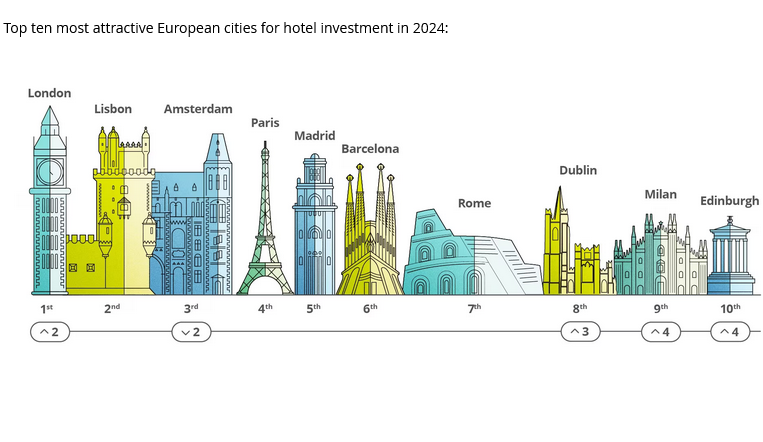

Hospitality leaders and investors have named London as the most attractive European city for hotel investment in the year ahead, according to the 2023 European Hotel Industry Survey by Deloitte.

The report asked senior hospitality leaders, owners, lenders, developers, and investors about the key trends that will shape the hospitality industry in 2024. The survey took place between 18 September and 10 October 2023.

The UK capital has risen two places since last year, with Lisbon retaining second place and Amsterdam falling to third. It is the first time since 2017 that Amsterdam has not been top spot. Hotels (39%) are rated the most attractive asset class to invest in 2024, rising by 15 percentage points from last year. This was followed by student housing (27%) and serviced apartments (16%).

The majority of respondents expect to see London’s Revenue Per Available Room (RevPAR) to grow in 2024. More than half (54%) expect the capital’s RevPAR to grow between 4% to 7% (up from 41% last year), while 72% of respondents anticipate a RevPar of between 1% to 5% in the UK regions this year (up from 53% in 2022).

Hotel executives also showed improved optimism in their expectations for London’s Gross Operating Profit per Available Room (GOPPAR) in 2024 compared to the last two years. The majority of respondents (58%) expect London’s GOPPAR growth to be 1% to 5%, up from 38% last year. However, the pressures that high inflation, labour shortages and greater energy prices are putting on profits has led to more than one in four respondents (28%) expecting 0% or negative GOPPAR growth in London in 2024.

Andreas Scriven, head of hospitality and leisure at Deloitte UK, commented: “It is reassuring to see London climb back up the rankings, and it is perhaps not surprising to see new hotels opening given the UK’s capital’s centre for tourism and business, as well has being a gateway city for international travel. For London to continue to remain attractive to hotel investors, the industry will need to address concerns around the ability to drive pricing in light of inflationary pressures.”

Across the UK regions, investors once again cited Edinburgh as the most attractive city for UK regional hotel investment for the third consecutive year. Oxford gained two places to become the second most attractive city in the UK, ahead of Manchester.

The proportion of respondents believing profitability will improve in the next five years has nearly doubled, rising from 38% in 2022 to 64% in 2023. In addition, nearly three-quarters of respondents (73%) said they are optimistic about the long-term future of the UK hotel market, up from 66% last year.

In a sign that deal activity could be accelerating in the hospitality sector, divestitures (24%) and acquisitions (58%) have both increased as key priorities for business leaders in the year ahead, rising by 18 percentage points and 16 percentage points, respectively year-on-year.

Scriven added: “Demand for quality hotel assets in the UK remains strong, with a range of capital looking to enter or expand in the market. However, in many cases there remains a bid-ask gap that has derailed a number of transactions in recent months. Whilst many potential buyers are still anticipating distressed transactional activity, vendors point to very strong operational performances to mitigate against the risk of distress and any associated price chipping.”

Hospitality leaders cited rising costs (89%), higher interest rates (87%), a shortage of skilled labour (85%) and increased staff costs (81%) as key concerns that will hinder growth in the year ahead. Demand fluctuations (48%), the inability to raise prices (45%), Generative AI (41%) and technology disruptions (39%) are all perceived as medium-term risks facing the industry.

The proportion of hospitality executives prioritising digital transformation projects in the year ahead saw a significant decrease year-on-year, with only 22% of respondents saying it is a key strategic priority compared to 48% in 2022.

Only one in four respondents (25%) see Generative AI as something that can help improve operational efficiency tasks, such as detecting fraudulent activities or generate new financial models.

Scriven concluded: “Concerningly, the current macroeconomic climate is forcing leaders to think about short-term solutions to stay in the black. To remain competitive, hospitality executives need to think about the parts of their business that can benefit from implementing the latest technologies, which will in turn benefit the bottom line.”