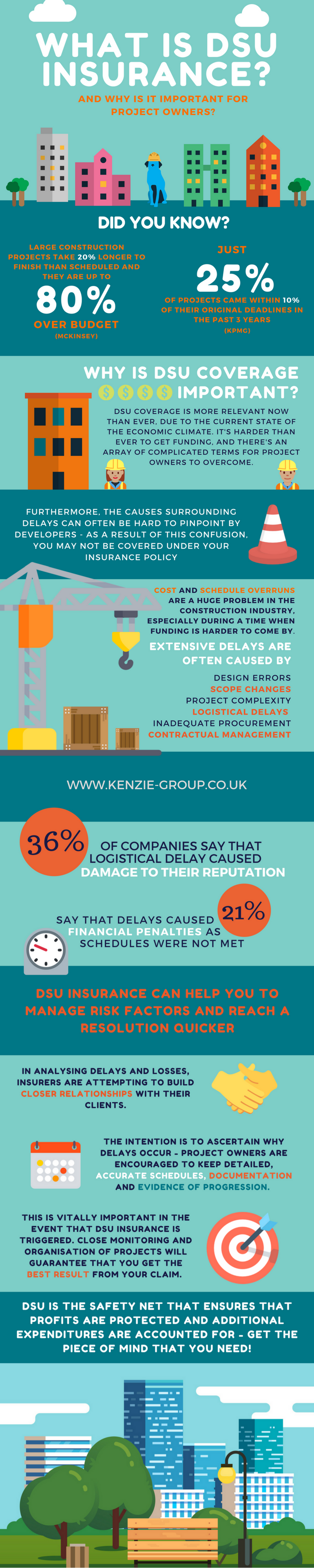

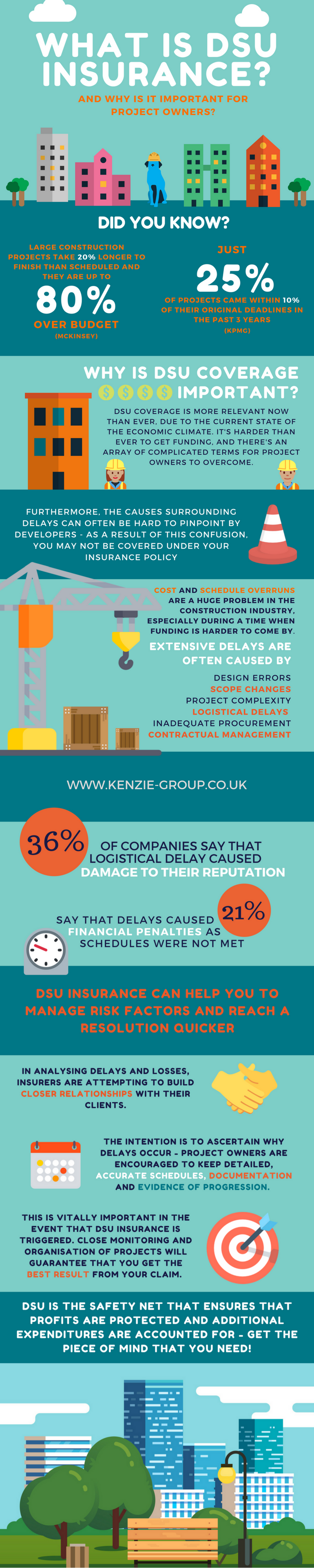

SU insurance is a

safety net for developers and construction companies that protects parties from

significant loss in circumstances where projects have suffered extensive

delays.

The knock-on impact

of delays can be devastating, especially where revenue streams are contingent

upon the completion of the project. In these circumstances, everybody involved

is affected - from contractors to suppliers, developers and back through to investors.

All of these parties

lose out if progress is postponed, leading to the procurement of extended

contracts to complete the

project and

additional funds to cover any equipment requirements, etc. In public projects,

such bridges, airports, and tunnels, stalled projects can affect multiple

businesses in a wide geographic area.

In recent years,

financial markets have become more cautious in funding large projects due to

the uncertainties associated with every step of the construction process.

More so than in the

past, delays resulting in financial loss pose more of a threat to the survival

of developers. Issues can arise from an array of issues.

Changes in scope,

designs, poor contractual management and planning can all cause teething

problems that, if left unchecked, snowball and cripple any developments

altogether.

Construction

requires reliable delivery of equipment and essential materials - now, if

there’s an unexpected event that affects a critical piece of machinery, then

there can be disastrous implications for the project owner.

The damage can then

extend to further expenditures, excessive loss of profits and revenue,

financial penalties and damage to the reputation of the company heading the

development.

To combat this

issue, DSU coverage helps to build close links between developers and insurers

to minimise and manage risk factors to hopefully pave the way for successful

projects that reach completion on time.

If an event does

trigger your cover, however, then the insurer will need detailed and organised

scheduling of progress, deliveries, any alterations, as well as any other vital

documentation. The more thorough the evidence, the easier the claim is to analyse

and attribute the root causes of delay.

Project monitoring

can help to combat any potential pitfalls - regularly reviewing how the project

changes and tracking each setback to quantify which part of the process caused

damage to the development is essential. For this to be achievable, the insured

parties need to provide access every three to six months to progress reports

and updates.

In taking out DSU cover, project owners benefit by gaining clarity so that they can move forward

with their project, as well as receiving reimbursement for the damage event(s).

Going forward, plans can be put in place to mitigate further potential losses.