Overall the

construction market is forecast to contract this year. Having fallen by 8% last

year, project starts are forecast to decline by just 1% in 2019 before

recovering 5% in 2020.

Whilst overall

construction starts will decline for a third consecutive year in 2019,

logistics premises, build to rent, student accommodation and social housing,

secondary education and civil engineering are forecast to be growth areas.

The most robust

increases are away from London and the South East, with rises in project starts

during 2019 expected in the South West of England, Scotland, Wales and Northern

Ireland.

A recovery in

projects starts is forecast for 2020, supported by a rise in private housing,

office, education, health and civil engineering projects.

Overall the value of

construction project starts declined by 8% last year. A smaller 1% fall is now

anticipated for 2019 before recovering next year. This outlook for the industry

is critically dependent upon the eventual realisation of a Brexit agreement and

the planned transition period. A no-deal Brexit would have a disruptive impact

on the UK economy and construction activity over the forecast period.

Weak UK economic

growth is forecast to constrain construction activity during 2019 and 2020.

Real household earnings are now rising, although growth is weak. This combined

with the extension of Help to Buy is forecast to lift new housing starts as

housing market conditions improve during 2020.

Increased investment

is anticipated in the secondary school estate to accommodate rising pupil

numbers, especially in the UK’s major conurbations.

Warehousing &

logistics premises are forecast to remain a growth area. Technological and

social changes are reshaping consumers’ retail habits and driving the demand

for logistics space. In addition, companies are investing in additional

warehousing capacity to help smooth potential supply chain disruptions

post-Brexit. Growth in this area will be overshadowed during 2019 by a

weakening in manufacturing investment in factory premises.

A weakening in

office starts is forecast for 2019. However, the recent recovery in approvals

during 2018 suggests renewed confidence among investors in the longer-term

prospects for the sector and is expected to feed through to a rise in project

starts from 2020.

Major infrastructure

schemes, including Thames Tideway, HS2 and Hinckley Point, are forecast to

drive civil engineering activity over the forecast period.

The value of smaller

scale civil engineering projects starting on site is also expected to improve,

having fallen back sharply over the last three years. Two other major

infrastructure schemes, Heathrow’s third runway development and the Stonehenge

tunnel are not expected to contribute during the period covered by this report

with initial works on both projects potentially commencing in 2023.

Longer term

construction is expected to benefit from increased public-sector investment as

the Government seeks to increase capital spending to improve UK

competitiveness. Network Rail’s £47 billion funding package for 2019 to 2024 is

an illustration of the Government’s commitment to greater investment in the

built environment.

The construction

industry is facing challenges from an aging workforce. The UK’s impending

departure from the EU has thrown the issue into sharper relief given the

industry’s reliance on overseas labour, particularly in London where EU

nationals account for 28% of the industry’s workforce. Recruitment of overseas

labour has already become more difficult following the referendum and the

weakening in Sterling. Reduced labour availability will add to contractors’

costs and will potentially act as a spur for the greater use of off-site

manufacture.

In the retail

sector, activity is forecast to decline over the forecast period as weak

consumer spending and the growth in online retailing accelerate the

restructuring of the retail industry and depress the demand for retail

premises.

The construction

industry is facing challenges from an aging workforce. The UK’s impending

departure from the EU has thrown the issue into sharper relief given the

industry’s reliance on overseas labour, particularly in London where EU

nationals account for 28% of the industry’s workforce. Recruitment of overseas

labour has already become more difficult following the referendum and the

weakening in Sterling. Reduced labour availability will add to contractors’

costs and will potentially act as a spur for the greater use of off-site

manufacture.

Key recommendations:

- Companies will need to

closely monitor and respond to shifting market conditions to maintain and

build their order books. Investment in an effective CRM, digital marketing

channels and a modernised salesforce will help firms to rapidly target

emerging opportunities.

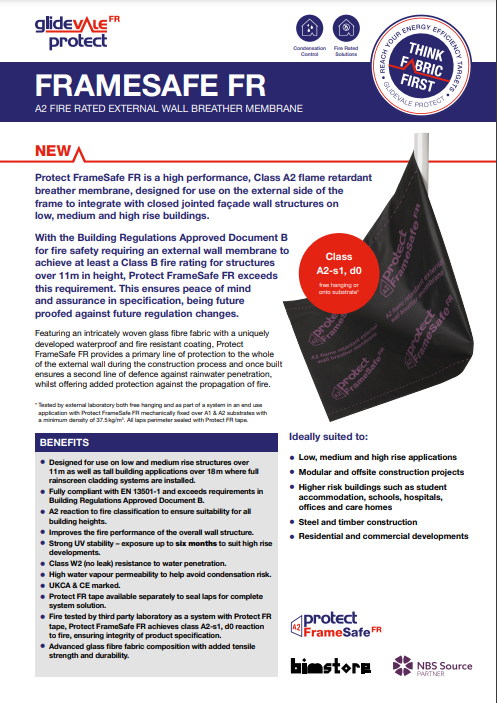

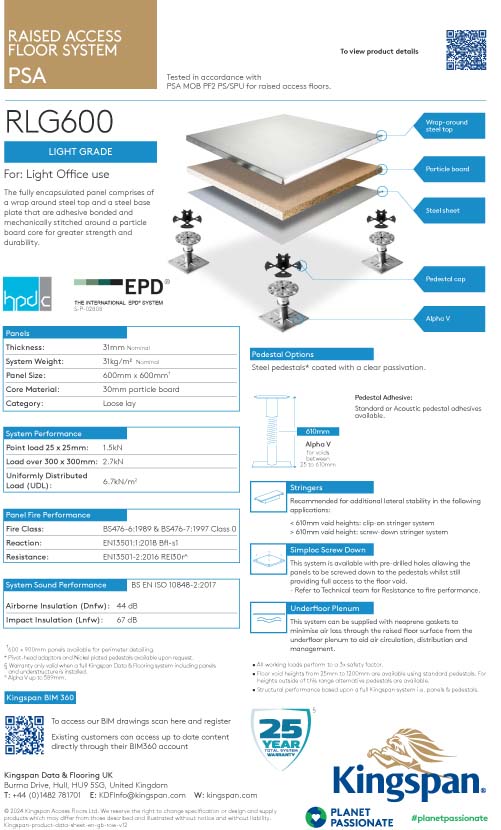

- The UK’s departure from the

EU is exacerbating the difficulty in recruiting skilled site labour. This

threatens to increase construction costs and disrupt the timely delivery

of projects. Companies should invest in design solutions, site operating

practices and offsite manufacturing options that reduce the reliance on

site labour to safeguard the timely and profitable delivery of projects.

- The fall in Sterling has

increased UK product manufacturers’ energy and raw material costs as well

as increasing the price of imported products. Firms will need to

adequately reflect rising labour and construction costs when tendering for

projects.

- Near term, firms will need to

scrutinise their supply chain arrangements carefully. The delay of the

Brexit date to 31 October provides firms with additional time to prepare.

The change to customs arrangements has the potential to disrupt the ready

availability of imported materials and components and their timely

delivery to site, especially in the event of a ‘No Deal Brexit’.